VictoriaMetrics: Ukrainian database company | With Co-Founder Aliaksandr Valialkin

A Ukrainian team quitely built a time-series database used by Spotify, Grammarly, CERN, and Roblox – rivaling billion-dollar competitors.

Hi! It’s Michael from Flyer One Ventures. I invest in pre-seed and seed Ukrainian and CEE founders building global software companies. This is my newsletter Underdogs - please subscribe to read the best stories of successful Eastern European tech companies.

In my previous article, I covered the story of Drizzle ORM, a cool team from Ukraine who built a widely popular product for developers (read it here).

Today I want to share another story of a great startup from Ukraine - VictoriaMetrics.

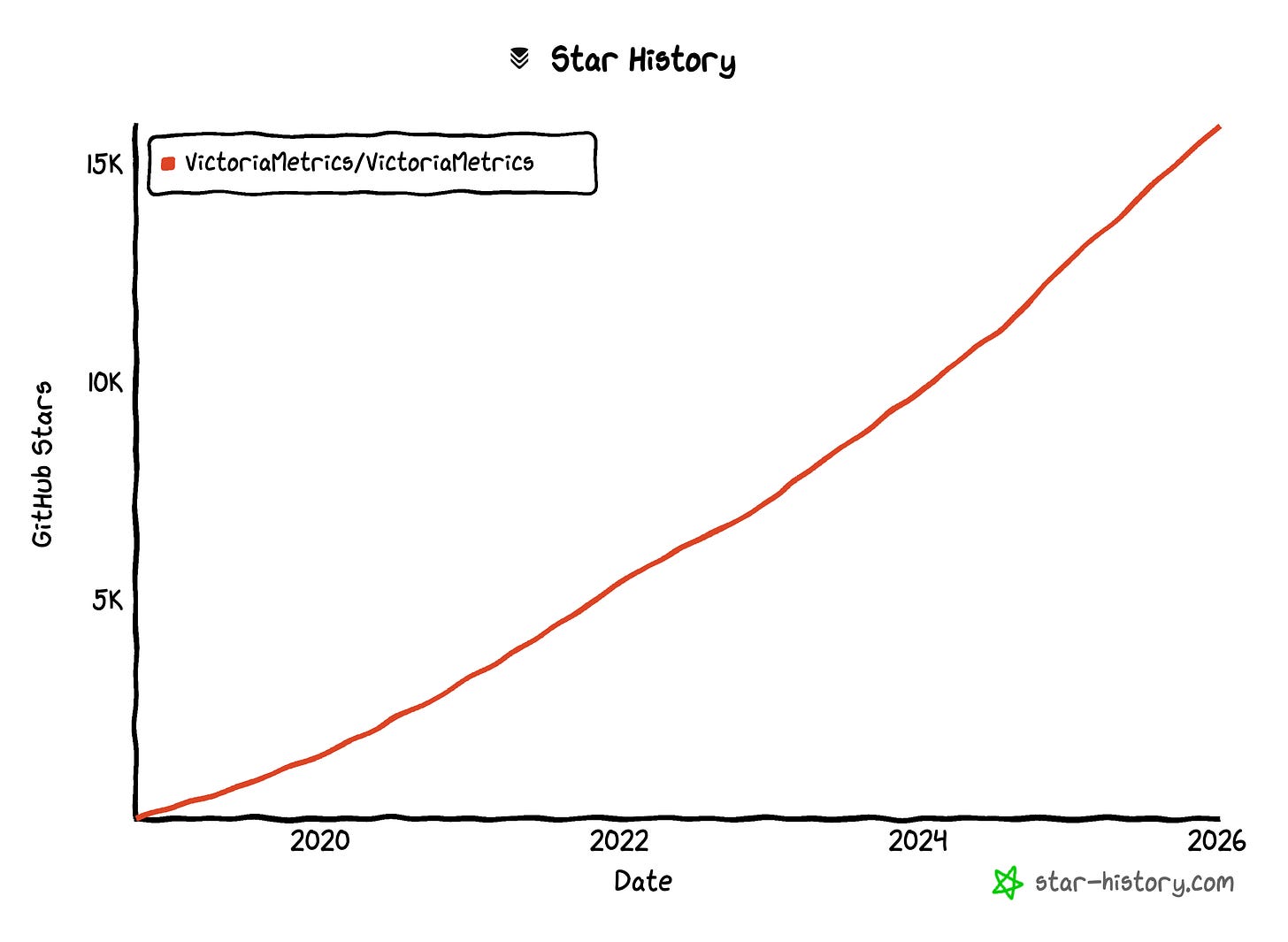

VictoriaMetrics is a time-series database company built for engineers by engineers. It was founded in Kyiv, Ukraine, and is now globally led and headquartered in the US. Since 2018, they have achieved remarkable results: 1B downloads, 16,000 GitHub stars, and 50+ large enterprise customers — all of this while being bootstrapped and profitable.

For this article, I did a deep dive into the business and had a conversation with co-founder Aliaksandr Valialkin, who shared details of their story. Enjoy!

Founding story

Founders

VictoriaMetrics was founded by Aliaksandr Valialkin (Linkedin, Twitter, GitHub), Roman Khavronenko (Linkedin, Twitter), Dzmitry Lazerka (Linkedin, Twitter), Artem Navoiev (Linkedin).

Aliaksandr is an engineer for 20+ years. Before the company, he was already well-known in the open-source community, especially among Go developers (he really does love Go). He had built projects like FastHTTP, which now has 23,000 stars on GitHub.

He met Dzmitry over 20 years ago when they worked together at an IT company in Minsk, Belarus.

Artem was the organizer of Go meetups in Kyiv. Aliaksandr was a regular attendee, and that’s how they became friends.

Roman was his colleague at VertaMedia, an AdTech company where they worked as software engineers from 2015 to 2017. And that’s were the founding story started.

Problem

VertaMedia had a very high volume of events — serving millions of requests per second — and they hit the breaking point with existing monitoring solutions. They were using PostgreSQL for ad analytics, but after a certain volume of events per second, it started working very slowly. They also used Zabbix (a popular open-source observation tool), but the developer experience was terrible.

In early 2017, Roman brought Prometheus to the company (it’s a de-facto standrart solution for logs monitoring). It worked great — but only for six months. Then Prometheus hit scalability limits and started working slowly.

They were searching for alternatives again, and Roman proposed trying ClickHouse. It was a success and worked very well — it allowed them to perform online analytics on billions of events in real time and reduce the number of servers from 15 to 1 (the number of servers then grew to 15 again, because they increased volume of events from 200k/second to 3m/second).

Aliaksandr started investigating the architecture of ClickHouse to see how it achieves such high performance. The architecture turned out to be quite simple.

A spark hit Aliaksandr — what if he could create a Prometheus-like monitoring solution, but with the architecture of ClickHouse for high performance and resource efficiency?

And that’s how VictoriaMetrics was born. Aliaksandr was so excited to build this that he decided to quit his job and start working on VictoriaMetrics full-time.

First steps

Before starting, Aliaksandr saved up enough money to live on for about two years. The plan was simple: 6 months for active development of the product, 6 months to market it, and then revenue would kick in.

The development of the product started in 2018. For the first 3 months, Aliaksandr worked alone. Then Roman, Artem, and Dzmitry started helping out in their free time while keeping their day jobs.

They joined the startup full-time only several years later (Roman worked at Cloudflare until 2021; Dzmitry worked at the space data platform Spire and Lyft until 2020; Artem worked at CloudSimple and Google until 2022). But they believed in VictoriaMetrics and helped wherever they could.

The initial product was finished in 6 months as expected. It was a closed-source cloud subscription product. So what was the plan now?

“We decided that the best way to market it was to provide a free version of VictoriaMetrics that could be installed on users’ machines. They could try it, realize that it works better than Prometheus, and then switch to our cloud version.”

We published the single-node version. The goal was to make it as simple as possible to start, so it runs as a single binary and without any configuration options — just runs out of the box. This was the initial idea — to simplify the evaluation of VictoriaMetrics by our users.

We published an article on Medium and on Hacker News, and it gained some attention. But it didn’t bring any paid users. So we started thinking about what to do next.”

They hit the problem: nobody wanted to use the product even though it was much better than Prometheus from a technology perspective.

The next 12 months ended up being extremely hard and frustrating — Aliaksandr burned through his savings while trying to get any traction. It was so bad that other co-founders helped him financially to continue the project.

Then an experienced advisor noticed the company through some publications and reached out: “I recommend you make VictoriaMetrics open-source. This will help you because it doesn’t require money. You just publish the open-source version of the product, and this will allow you to gain popularity among users.”

The team listened — and made VictoriaMetrics open-source in April 2019. After that, they saw a good stream of new users and a steady increase in GitHub stars.

First customer

At that time, Wix (a publicly listed web development platform, $1.8B revenue, 5000+ employees) decided to switch from Prometheus for monitoring all of their infrastructure.

They found VictoriaMetrics via some of the initial publications on Medium and Hacker News and started using the single binary the team published for users’ evaluation.

Before that, Wix was exploring several other options, but VictoriaMetrics turned out to be the best fit for their needs — so they decided to use it.

Wix wanted to make sure that everything would work properly and VictoriaMetrics could help in case something went wrong — so they proposed signing a technical support contract. “We’ll pay you money, and you will provide us with technical support when we need it.”

So, a few months after going open-source and ±1.5 years since starting VictoriaMetrics, they signed Wix as their first customer. (Six years later, Wix is still a customer.)

After some time, the team completely closed the cloud direction and focused on technical support contracts.

Product

There are dozens of database types: Relational databases, NoSQL/document databases (like MongoDB), Graph databases, Key-value databases, Vector databases, Time-series databases.

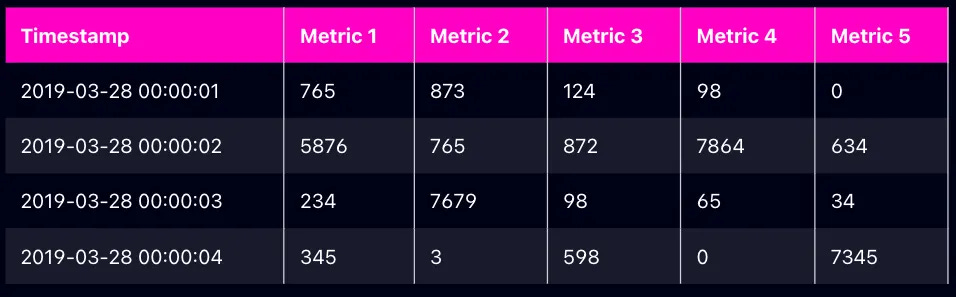

VictoriaMetrics is a time-series database (TSDB) — a specialized database optimized for handling time-stamped data, such as metrics, events, and measurements collected over time. How time series databases save stuff:

Company has 3 core parts of the product offering:

VictoriaMetrics (the original product) stores and queries metrics — like CPU usage, request counts, error rates, etc. It also has MetricsQL — its own query language, similar to PromQL by Prometheus.

VictoriaLogs is their database for logs — records of events that applications generate. It has its own query language called LogsQL. As a product, it competes with Elasticsearch and Grafana Loki.

VictoriaTraces is the newest product — a database for distributed traces. Traces show how requests flow through microservices, helping developers debug performance issues. It accepts data in OpenTelemetry format and integrates with Grafana and Jaeger for visualization.

Market

There are hundreds of databases (428+ listed in this rank), and it’s a market of $50+ billion annually (dominated by Oracle, Microsoft, IBM, and other Big Tech companies).

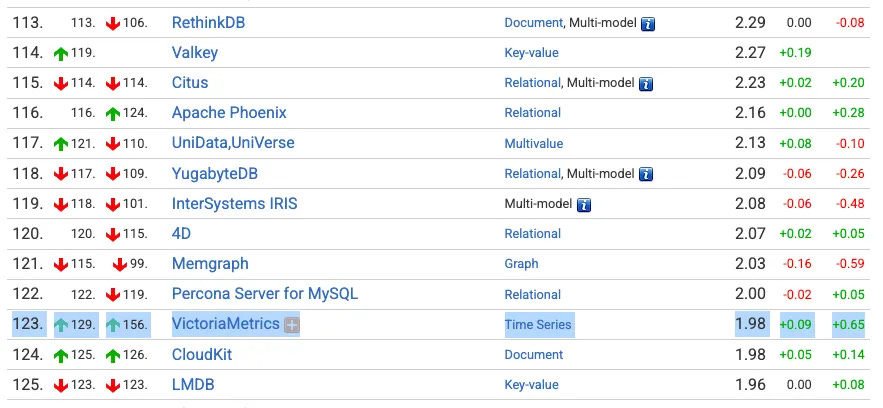

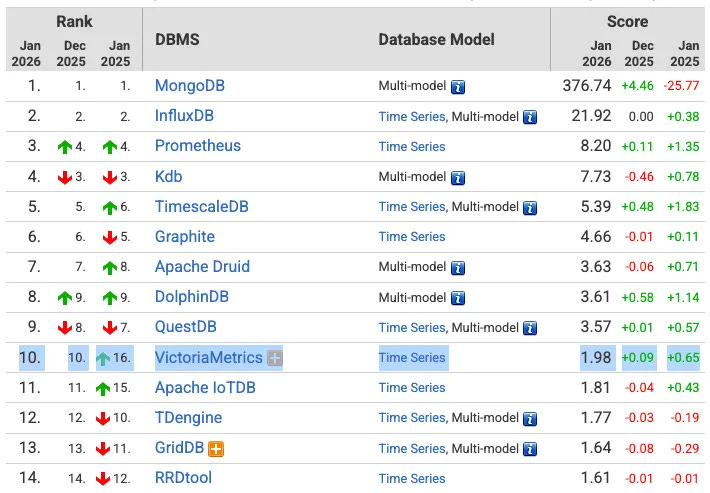

A website called DB-Engines is doing regular popularity rankings of databases. In the overall ranking, VictoriaMetrics ranks 123/428 with a score of 1.98 - a decent result.

Among time-series databases VictoriaMetrics rank 10/45.

Competition

There are several competing products/companies:

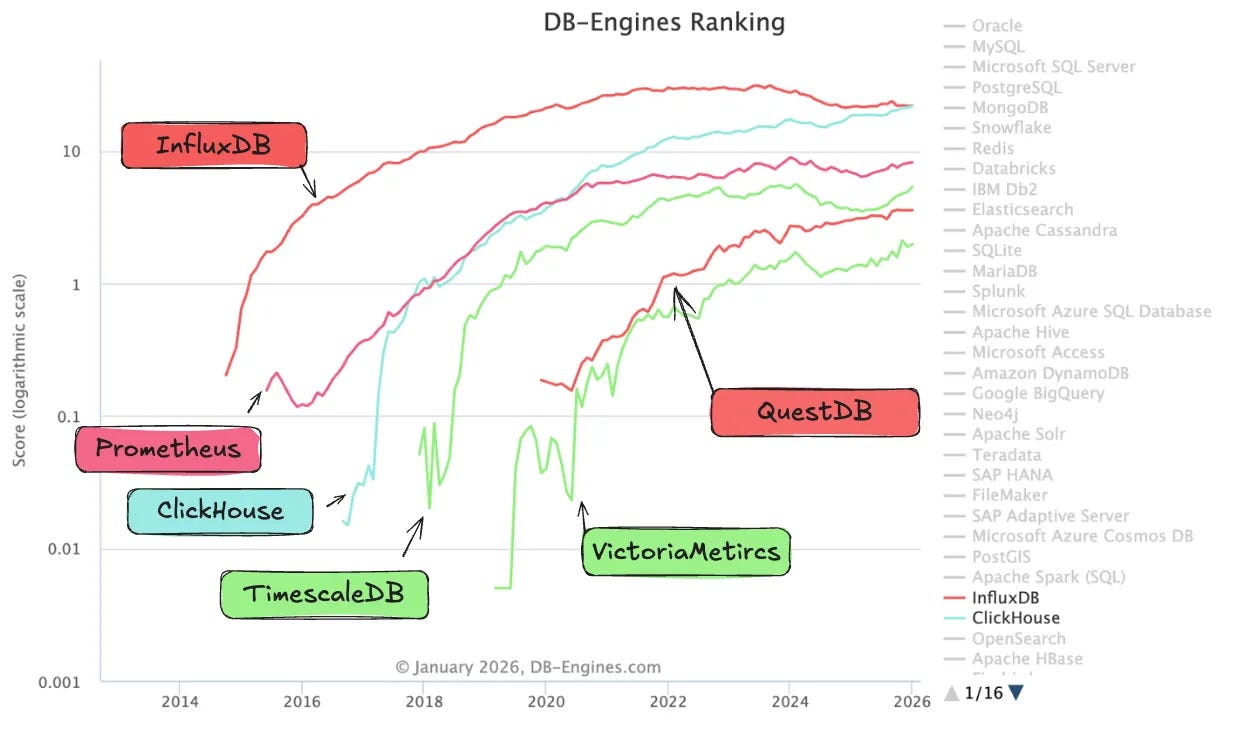

Prometheus is an open-source monitoring system and time-series database. It was originally developed in 2012 at SoundCloud. Now Prometheus is not a company — it’s a pure open-source project with no commercial entity behind it. It has 62,100 GitHub stars, and over the years it has become the de facto standard for metrics-based monitoring. Score of 8.20 among time-series databases (4x vs VictoriaMetrics).

InfluxDB - US-based time-series database company, founded in 2012. Raised $200m in total, including $81m Series E in 2023. TechCrunch reported 1,900 commercial clients and 750,000 users in 2023. One source reports them to be at $75m ARR in 2024. Among time-series databases, they rank #1, with a score of 21.92 (11x vs VictoriaMetrics).

TimescaleDB - a popular time-series database, founded in 2014. Created by the startup called Timescale, which rebranded into Tiger Data in 2025. Initially, they were developing a platform to collect, store, and analyze IoT data, but they pivoted to a time-series database. Raised $180m in total and was valued at $1 billion after a $110m Series C in Feb-2024. Score of 5.39 among time-series databases (2.5x vs VictoriaMetrics).

QuestDB - UK-based open-source time-series database, founded in 2019. They went through YC in 2020 and raised $14.3M in total. QuestDB is focused on the financial industry (capital markets, FX, crypto), and both founders have a financial industry background. Among time-series databases, they rank #9, with a score of 3.57, 1.7x vs VictoriaMetrics. By the way, one of QuestDB’s founders is a Ukrainian guy Vlad Ilyushchenko. What a pleasant surprise!

ClickHouse is a column-oriented database built for real-time analytics. Strictly speaking, it’s not a time-series database, but it is often used for the same purposes. ClickHouse started in 2012 as an internal project inside Yandex, a russian internet giant. In 2016, ClickHouse was released as an open-source project. In 2021, founders incorporated the company and spun off from Yandex. Since then, ClickHouse raised $650m, achieved a $6.3B valuation, and estimated $100m ARR. Has a database score of 21.77 (only ±10x more popular vs VictoriaMetrics).

Chronosphere, observability platform for metrics/traces/logs founded in the US in 2019. They started with an open-source time series database m3db at the same time as VictoriaMetrics. Since then company raised $370m and were acquired for $3.3 billion in 2025 by Palo Alto Networks.

Here is how the popularity of these databases looks on a logarithmic scale chart:

Overall, it’s a really big market. A niche of time-series databases can easily have several billion-dollar companies.

Business model: open source + subscription for customer support

The company uses an open-source model. 99% of functionality is free and open to everyone.

There is an enterprise plan with the remaining 1% of closed-source features (security, user and access management) needed by some companies, but not essential for most users.

However, most enterprise customers keep using the open-source version — they just pay for dedicated “technical support contracts,” which are the core part of the business and monetization.

Aliaksandr explains how technical support contracts work:

“Customers sign a technical support contract with us, which includes predefined SLAs and other conditions. Every contract is custom — we negotiate terms with each customer individually. The price depends on many factors: what they want from us, what workloads they’re monitoring, how much they currently spend on monitoring infrastructure, and how much they’re ready to pay. It’s our sales team’s job to figure out all the requirements and negotiate a price that works for both sides.

We usually sign contracts for one year, sometimes longer. After each year, we renew and may adjust the terms — usually increasing the price because of additional services we provide or increased usage of VictoriaMetrics by the customer.

Customers typically run VictoriaMetrics on their own hardware and come to us for consultations or help when something goes wrong or when they need to optimize for specific workloads.

The feature-only contracts have a fixed, much lower price because they require almost no work from our side. But the majority of our contracts include support, so they’re more expensive.”

“Wait, what? Can you even do that?” - my thoughts when Aliaksandr explained it.

Actually, this model works pretty well! It was pioneered by Red Hat - a US tech company that built a $6.5 billion ARR business by giving software away for free and monetizing enterprise support subscriptions. Red Hat is a goliath of open-source, and was acquired by IBM in 2019 for $33,4 billion.

This directly challenges one of the VC market’s “holy truths” - that serious software businesses must monetize through cloud subscriptions.

G2M strategy

Here is the interesting part: 100% of customers came via inbound sales.

The customer acquisition funnel looks like this:

DevOps, SRE, Software Engineers from company X find VictoriaMetrics (SEO, GitHub, rankings, etc.)

They start testing an open-source version for free.

Over time, they use it on more and more workflows. VictoriaMetrics becomes a large part of their infrastructure.

Of course, it requires increasing support, maintenance, and issue resolution. Now company X has 2 choices: a) do it by themselves and dedicate their own engineering force for this b) sign a technical support contract with VictoriaMetrics, which will guarantee dedicated white-glove support by people who built the thing.

They go to https://victoriametrics.com/ and contact sales with the contact form.

Sales team picks up the deal and negotiates the contract.

Per Aliaksandr, they tried outbound sales multiple times, but this didn’t end up getting any contracts.

Why? Well, my guess is that selling to a) developers b) in enterprises is a very hard thing to do. J. Robert Oppenheimer perfectly explains their approach to buying:

Clients, Metrics, Growth

1) Today the company has 50+ customers with custom enterprise contracts and many more on self-service enterprise/cloud plans (the team brought back cloud a few years ago).

Customer list includes companies like: Hubspot, Wix.com, Grammarly, Roblox, Spotify, Zomato, Razorpay, Synthesio, Brandwatch, Xiaohongshu, and CERN (home of the Large Hadron Collider).

2) VictoriaMetrics also has a tradition of publishing annual review articles. Some of the metrics they shared publicly:

2021: 5k GitHub stars, 800k+ GitHub downloads, 36M+ Docker pulls

2022: 100M+ downloads and triple-digit enterprise growth

2023: 13k GitHub stars, 268 million VictoriaMetrics downloads, 320% enterprise growth

2024: 300%+ enterprise growth, 50% headcount growth

2025: Hit 1 billion downloads on Docker Hub, 50% headcount growth

3) 15900 GitHub stars as of Jan-2026 (Star history)

4) And most importantly: profitable and with 100% customer retention.

“We have 100% customer retention rate. We lost some customers who couldn’t pay - went bankrupt. But we never lost customers due to product or service quality.“ Aliaksandr shared.

Company now and vision

Aliaksandr is very explicit about the ambition:

Our goal is to become the default open-source solution in observability - across metrics, logs, and traces.

In practice, that means two things: first, beating Prometheus, which is currently the default open-source solution for metrics; second, surpassing Elasticsearch, which is the leader in the open-source space for logs.

What makes this more interesting is how the company got here. VictoriaMetrics is fully bootstrapped, unlike most direct competitors that have raised hundreds of millions in external capital.

This may look like a clean success story in hindsight, but the early days were anything but easy. Not only was it super hard to get any customers during the first year and a half, but the team also actively sought outside investments at the beginning, but were unable to secure any funding. They also applied to Y Combinator in their first year and were rejected.

However, even without the investments, the team managed to bootstrap and grow the company at a strong pace. Regardless of whether they decide to raise growth funding or not, VictoriaMetrics has a good shot at winning over the market or becoming the next Ukrainian-born unicorn.

Learnings for other founders

There are a couple of important learnings I noted from Aliaksandr and VictoriaMetrics’ story:

You can (and should) reverse-engineer how a great product works — and use the best practices from them. Aliaksandr investigated Clickhouse architecture, which helped him build a product superior to Prometheus.

A cloud subscription model doesn’t always work. If customers need to benchmark performance against the tools they already use, a paywall can get in the way. This might not be a big issue with consumer/prosumer tools that cost $50/mo. But it’s very different for large enterprises. When a company is deciding where to store and query billions of rows of data, any friction — especially upfront pricing barriers — can slow or block adoption.

It’s possible to add a service component to the business model. Many open-source companies also struggle with monetization of their cloud offerings. VictoriaMetrics is monetizing with technical support contracts: provide an open-source product for free + subscription for customer support and maintenance.

Don’t give up! Early years are rarely smooth. You will hit funding rejections, cash constraints, slow customer adoption, and long periods where progress feels invisible. That’s normal. The key lesson is persistence. If you keep improving the product and solving a real problem better than existing alternatives, traction compounds over time. Great products don’t always win fast — but they tend to win eventually. Stay focused, keep shipping, and give the market enough time to catch up.